Summary

- The S&P 500 has pulled back 4% from recent highs, but it's not due to geopolitical tension.

- Rates, the dollar, yen, and oil are not reflecting typical flight to safety characteristics.

- Markets are correcting for their massive blunder.

- Looking for a helping hand in the market? Members of Reading The Markets get exclusive ideas and guidance to navigate any climate. Learn More »

Paul Souders/DigitalVision via Getty Images

The S&P 500 has pulled back about 4.6% from its recent highs, which is nothing to cause great concern. However, the declines thus far have been due to the market's changing expectations around the path of monetary policy, not the geopolitical tension many media outlets and market pundits have pointed to. The evidence is within the market and is critical to understand because it may determine where it is heading.

In this case, geopolitical tensions are the easy and obvious headline explaining the recent stock pullback. But that's not really what's happening when digging deeper because rates, the dollar, the yen, and oil do not reflect the typical flight to safety trades one would expect.

No Flight To Safety

In most flight-to-safety situations, the obvious observations are bond yields going lower, the dollar strengthening against most major currencies, the yen strengthening vs. the dollar, and, with rising Middle East tensions, surging oil.

Since the hotter-than-expected CPI report, the 10-year rate has soared, and it hasn't come down, instead rising to about 4.61% from its closing rate of 4.36% on March 9. Yes, the dollar has strengthened, but the yen has weakened from 151.70 to around 154.40. Meanwhile, oil prices have been declining. You're just not seeing the typical flight-to-safety trades happening.

Financial Conditions Are Tightening

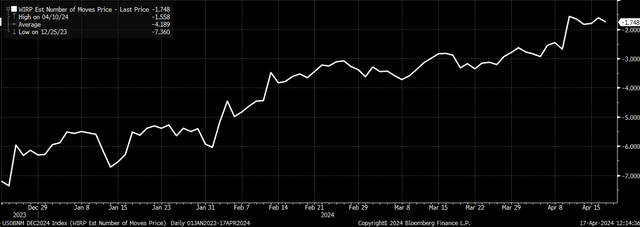

What you're seeing are credit spreads widening, coupled with higher rates, and creating tighter financial conditions, and that's in response to a Fed monetary policy that's going to continue to be higher for longer because inflation, as Jay Powell noted on April 16, has stalled out, which means the Fed no longer has the confidence it needs to cut rates "soon." That now has the market pricing in fewer than two rate cuts in 2024 and now sees the first rate coming in November.

Bloomberg

Tighter financial conditions make this pullback different from what has been witnessed since the October lows when financial conditions started to ease. The market is correcting its errors, and now the Fed is back peddling rate cuts for 2024. That means the declines in equities we have seen are closer to the beginning than the end because financial conditions still need to tighten considerably further to transmit policy that will start to cool the economy and bring down inflation.

A Fantasy

Bloomberg

The equity market rally was driven by easing financial conditions and multiple expansion, not because the outlook for earnings was improving, but because earnings estimates for 2024 haven't changed since the fall of 2022. As financial conditions tighten, the PE ratio of the S&P 500 will contract, and the gains will be given back.

You may be very disappointed if you're betting that this is some normal pullback in a bull market. What's happening is that the market made a mistake, and now it will need to correct that mistake.

Join Reading The Markets Risk-Free With A Two-Week Trial!

(*The Free Trial offer is not available in the App Store)

Reading the Markets helps readers cut through all the noise, delivering daily video and written market commentaries to prepare you for upcoming events.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Charts used with the permission of Bloomberg Finance L.P. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.